Hewlett Packard (HPQ) is continuing to drive further action on its end-to-end cost structure. The company provides solutions to individual customers and enterprises. Its personal systems segment offers computers and related products for the commercial and consumer markets. Its enterprises group segment offers servers and other solutions to customers. Hewlett Packard's printing segment provides printer hardware and other solutions to businesses. The company's enterprises segment offers technology consulting and business services. Hewlett Packard was founded in 1939 and is headquartered in Palo Alto.

Financials

Hewlett Packard reclaimed its number one position in both commercial PCs and desktop sectors against the backdrop of a declining market. In the second quarter, the company delivered $0.88 in diluted non-GAAP net earnings per share. This is at the high-end of the company's financial outlook of $0.85 to $0.89 per share. The company's revenue was flat in a constant currency, but Hewlett Packard delivered a very strong cash flow of $3 billion from operations. The company's results were driven by solid performances in its printing, networking, and personal systems segments. In the personal systems segment, Hewlett Packard's revenue went up 7% over the same period in the prior year.

Positive Outlook

For the full-year 2014, Hewlett Packard expects a non-GAAP diluted earnings per share of $3.63 to $3.75. From a GAAP perspective, it expects full-year earnings to be in the range of $2.68 to $2.80. The company expects GAAP net earnings per share for the next quarter to be in the range of $0.59 to $0.63.

Initiatives

Hewlett Packard created a joint venture with Foxconn. Together, both companies will be building a new line of cloud-optimized servers. The partnership intends to redefine the infrastructure economics of the world's largest service providers.

Hewlett Packard's services bookings growth is encouraging. The U.S. Department of Homeland Security awarded Hewlett Packard a cyber security contract worth up to $32 million. Belgium's Flemish government awarded the company a seven-year EUR 500 million contract to offer ICT services to all local and government entities.

Competition

Hewlett Packard's market rivals include Accenture (ACN), International Business Machines (IBM), and the privately held Dell. To gain advantage over the competition, Hewlett Packard is building a lean organization with a focus on its strong performance management.

International Expansion

Hewlett Packard, during the early part of the millennium, was able to realize great returns by expanding its operations in China, India, Brazil and other countries. It has continued with the tradition.

Wings Across China

Recently, China Mobile Limited selected Hewlett Packard's Intelligent Data Operating Layer to power the search capability of its strategic Wireless City platform. Also, Hewlett-Packard teamed up with global packaging company YFY Jupiter for a new initiative that will use straw waste in China to create packaging materials for its products. The program will create multifold benefits for HP.

Latin America and other Asian countries

Hewlett Packard has been active in Latin America and Asia. It announced the rollout of its partnerONE initiative in Asia Pacific and Latin America. The project is designed to help the company's partners to grow top line revenue and bottom line profitability. Ultimately, Hewlett Packard wants to use the project to boost its revenue.

Conclusion

Hewlett Packard's businesses cut across the major segments in the computer systems industry. It is positioned to meet the needs of the ever-changing market environment of its sector. The company is optimizing its workforce and reengineering its operations to create the capacity to drive a future growth. Overall, the company has enough room to expand on the international level. Also, its positive cash flow levels are bound to experience a growth in the future. I feel bullish about Hewlett Packard's future profitability.

| Currently 0.00/512345 Rating: 0.0/5 (0 votes) | |

Subscribe via Email

Subscribe RSS Comments Please leave your comment:

More GuruFocus Links

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

MORE GURUFOCUS LINKS

| Latest Guru Picks | Value Strategies |

| Warren Buffett Portfolio | Ben Graham Net-Net |

| Real Time Picks | Buffett-Munger Screener |

| Aggregated Portfolio | Undervalued Predictable |

| ETFs, Options | Low P/S Companies |

| Insider Trends | 10-Year Financials |

| 52-Week Lows | Interactive Charts |

| Model Portfolios | DCF Calculator |

RSS Feed  | Monthly Newsletters |

| The All-In-One Screener | Portfolio Tracking Tool |

HPQ STOCK PRICE CHART

33.5 (1y: +35%) $(function(){var seriesOptions=[],yAxisOptions=[],name='HPQ',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1370235600000,24.9],[1370322000000,24.62],[1370408400000,24.19],[1370494800000,24.25],[1370581200000,24.81],[1370840400000,24.49],[1370926800000,24.24],[1371013200000,24.91],[1371099600000,24.93],[1371186000000,24.74],[1371445200000,25.16],[1371531600000,25.44],[1371618000000,25.43],[1371704400000,24.72],[1371790800000,24.15],[1372050000000,23.43],[1372136400000,23.85],[1372222800000,24.01],[1372309200000,24.77],[1372395600000,24.8],[1372654800000,24.93],[1372741200000,25.02],[1372827600000,25.18],[1373000400000,25.58],[1373259600000,25.17],[1373346000000,25.47],[1373432400000,25.93],[1373518800000,26.38],[1373605200000,26.19],[1373864400000,26.38],[1373950800000,26.45],[1374037200000,26.31],[1374123600000,26.33],[1374210000000,25.14],[1374469200000,25.51],[1374555600000,25.73],[1374642000000,26.11],[1374728400000,26.24],[1374814800000,25.99],[1375074000000,25.67],[1375160400000,25.78],[1375246800000,25.68],[1375333200000,26.23],[1375419600000,27],[1375678800000,27.03],[1375765200000,26.44],[1375851600000,26.69],[1375938000000,26.87],[1376024400000,26.77],[1376283600000,26.74],[1376370000000,27.3],[1376456400000,27.18],[1376542800000,25.95],[1376629200000,26.42],[1376888400000,25.88],[1376974800000,25.84],[1377061200000,25.38],[1377147600000,22.22],[1377234000000,22.4],[1377493200000,22.27],[1377579600000,21.99],[1377666000000,22.61],[1377752400000,22.52],[1377838800000,22.34],[1378184400000,22.37],[1378270800000,22.27],[1378357200000,22.12],[1378443600000,22.42],[1378702800000,22.36],[1378789200000,22.27],[1378875600000,22.27],[1378962000000,21.96],[1379048400000,22.07],[1379307600000,21.74],[1379394000000,21.67],[1379480400000,21.795],[1379566800000,21.31],[1379653200000,21.22],[1379912400000,21.2],[1379998800000,21.24],[1380085200000,21.4],[1380171600000,21.3],[1380258000000,21.17],[1380517200000,20.99],[1380603600000,21.31],[1380690000000,21.4],[1380776400000,20.92],[1380! 862800000,21.26],[1381122000000,20.93],[1381208400000,20.75],[1381294800000,22.6],[1381381200000,22.32],[1381467600000,22.8],[1381726800000,22.9],[1381813200000,22.79],[1381899600000,23.28],[1381986000000,23.385],[1382072400000,23.48],[1382331600000,23.55],[1382418000000,24.05],[1382504400000,23.76],[1382590800000,23.88],[1382677200000,24],[1382936400000,23.86],[1383022800000,23.84],[1383109200000,24.2],[1383195600000,24.37],[1383282000000,25.92],[1383544800000,25.77],[1383631200000,25.47],[1383717600000,25.61],[1383804000000,25.69],[1383890400000,25.94],[1384149600000,26.35],[1384236000000,26.22],[1384322400000,26.49],[1384408800000,25.07],[1384495200000,25.21],[1384754400000,25],[1384840800000,24.99],[1384927200000,24.94],[1385013600000,25.03],[1385100000000,25.26],[1385359200000,25.32],[1385445600000,25.09],[1385532000000,27.36],[1385704800000,27.35],[1385964000000,27.32],[1386050400

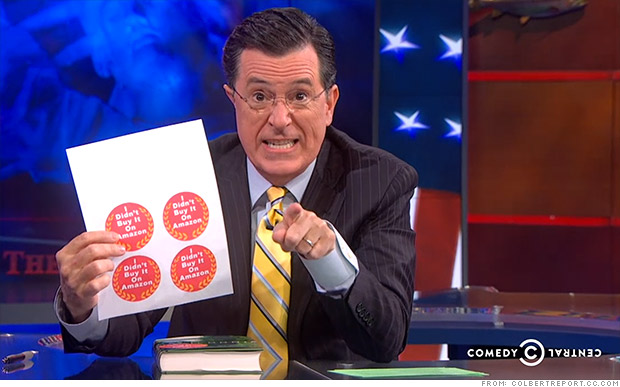

NEW YORK (CNNMoney) For Stephen Colbert, the Amazon-Hachette feud is getting personal.

NEW YORK (CNNMoney) For Stephen Colbert, the Amazon-Hachette feud is getting personal.  Colbert a safe choice to replace Letterman

Colbert a safe choice to replace Letterman  For dividend investors, there’s good news … and bad news.

For dividend investors, there’s good news … and bad news. Dividend Yield: 3.02%

Dividend Yield: 3.02% Dividend Yield: 3.31%

Dividend Yield: 3.31% Dividend Yield: 4.23%

Dividend Yield: 4.23%

MORE GURUFOCUS LINKS

MORE GURUFOCUS LINKS  33.5 (1y: +35%) $(function(){var seriesOptions=[],yAxisOptions=[],name='HPQ',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1370235600000,24.9],[1370322000000,24.62],[1370408400000,24.19],[1370494800000,24.25],[1370581200000,24.81],[1370840400000,24.49],[1370926800000,24.24],[1371013200000,24.91],[1371099600000,24.93],[1371186000000,24.74],[1371445200000,25.16],[1371531600000,25.44],[1371618000000,25.43],[1371704400000,24.72],[1371790800000,24.15],[1372050000000,23.43],[1372136400000,23.85],[1372222800000,24.01],[1372309200000,24.77],[1372395600000,24.8],[1372654800000,24.93],[1372741200000,25.02],[1372827600000,25.18],[1373000400000,25.58],[1373259600000,25.17],[1373346000000,25.47],[1373432400000,25.93],[1373518800000,26.38],[1373605200000,26.19],[1373864400000,26.38],[1373950800000,26.45],[1374037200000,26.31],[1374123600000,26.33],[1374210000000,25.14],[1374469200000,25.51],[1374555600000,25.73],[1374642000000,26.11],[1374728400000,26.24],[1374814800000,25.99],[1375074000000,25.67],[1375160400000,25.78],[1375246800000,25.68],[1375333200000,26.23],[1375419600000,27],[1375678800000,27.03],[1375765200000,26.44],[1375851600000,26.69],[1375938000000,26.87],[1376024400000,26.77],[1376283600000,26.74],[1376370000000,27.3],[1376456400000,27.18],[1376542800000,25.95],[1376629200000,26.42],[1376888400000,25.88],[1376974800000,25.84],[1377061200000,25.38],[1377147600000,22.22],[1377234000000,22.4],[1377493200000,22.27],[1377579600000,21.99],[1377666000000,22.61],[1377752400000,22.52],[1377838800000,22.34],[1378184400000,22.37],[1378270800000,22.27],[1378357200000,22.12],[1378443600000,22.42],[1378702800000,22.36],[1378789200000,22.27],[1378875600000,22.27],[1378962000000,21.96],[1379048400000,22.07],[1379307600000,21.74],[1379394000000,21.67],[1379480400000,21.795],[1379566800000,21.31],[1379653200000,21.22],[1379912400000,21.2],[1379998800000,21.24],[1380085200000,21.4],[1380171600000,21.3],[1380258000000,21.17],[1380517200000,20.99],[1380603600000,21.31],[1380690000000,21.4],[1380776400000,20.92],[1380! 862800000,21.26],[1381122000000,20.93],[1381208400000,20.75],[1381294800000,22.6],[1381381200000,22.32],[1381467600000,22.8],[1381726800000,22.9],[1381813200000,22.79],[1381899600000,23.28],[1381986000000,23.385],[1382072400000,23.48],[1382331600000,23.55],[1382418000000,24.05],[1382504400000,23.76],[1382590800000,23.88],[1382677200000,24],[1382936400000,23.86],[1383022800000,23.84],[1383109200000,24.2],[1383195600000,24.37],[1383282000000,25.92],[1383544800000,25.77],[1383631200000,25.47],[1383717600000,25.61],[1383804000000,25.69],[1383890400000,25.94],[1384149600000,26.35],[1384236000000,26.22],[1384322400000,26.49],[1384408800000,25.07],[1384495200000,25.21],[1384754400000,25],[1384840800000,24.99],[1384927200000,24.94],[1385013600000,25.03],[1385100000000,25.26],[1385359200000,25.32],[1385445600000,25.09],[1385532000000,27.36],[1385704800000,27.35],[1385964000000,27.32],[1386050400

33.5 (1y: +35%) $(function(){var seriesOptions=[],yAxisOptions=[],name='HPQ',display='';Highcharts.setOptions({global:{useUTC:true}});var d=new Date();$current_day=d.getDay();if($current_day==5||$current_day==0||$current_day==6){day=4;}else{day=7;} seriesOptions[0]={id:name,animation:false,color:'#4572A7',lineWidth:1,name:name.toUpperCase()+' stock price',threshold:null,data:[[1370235600000,24.9],[1370322000000,24.62],[1370408400000,24.19],[1370494800000,24.25],[1370581200000,24.81],[1370840400000,24.49],[1370926800000,24.24],[1371013200000,24.91],[1371099600000,24.93],[1371186000000,24.74],[1371445200000,25.16],[1371531600000,25.44],[1371618000000,25.43],[1371704400000,24.72],[1371790800000,24.15],[1372050000000,23.43],[1372136400000,23.85],[1372222800000,24.01],[1372309200000,24.77],[1372395600000,24.8],[1372654800000,24.93],[1372741200000,25.02],[1372827600000,25.18],[1373000400000,25.58],[1373259600000,25.17],[1373346000000,25.47],[1373432400000,25.93],[1373518800000,26.38],[1373605200000,26.19],[1373864400000,26.38],[1373950800000,26.45],[1374037200000,26.31],[1374123600000,26.33],[1374210000000,25.14],[1374469200000,25.51],[1374555600000,25.73],[1374642000000,26.11],[1374728400000,26.24],[1374814800000,25.99],[1375074000000,25.67],[1375160400000,25.78],[1375246800000,25.68],[1375333200000,26.23],[1375419600000,27],[1375678800000,27.03],[1375765200000,26.44],[1375851600000,26.69],[1375938000000,26.87],[1376024400000,26.77],[1376283600000,26.74],[1376370000000,27.3],[1376456400000,27.18],[1376542800000,25.95],[1376629200000,26.42],[1376888400000,25.88],[1376974800000,25.84],[1377061200000,25.38],[1377147600000,22.22],[1377234000000,22.4],[1377493200000,22.27],[1377579600000,21.99],[1377666000000,22.61],[1377752400000,22.52],[1377838800000,22.34],[1378184400000,22.37],[1378270800000,22.27],[1378357200000,22.12],[1378443600000,22.42],[1378702800000,22.36],[1378789200000,22.27],[1378875600000,22.27],[1378962000000,21.96],[1379048400000,22.07],[1379307600000,21.74],[1379394000000,21.67],[1379480400000,21.795],[1379566800000,21.31],[1379653200000,21.22],[1379912400000,21.2],[1379998800000,21.24],[1380085200000,21.4],[1380171600000,21.3],[1380258000000,21.17],[1380517200000,20.99],[1380603600000,21.31],[1380690000000,21.4],[1380776400000,20.92],[1380! 862800000,21.26],[1381122000000,20.93],[1381208400000,20.75],[1381294800000,22.6],[1381381200000,22.32],[1381467600000,22.8],[1381726800000,22.9],[1381813200000,22.79],[1381899600000,23.28],[1381986000000,23.385],[1382072400000,23.48],[1382331600000,23.55],[1382418000000,24.05],[1382504400000,23.76],[1382590800000,23.88],[1382677200000,24],[1382936400000,23.86],[1383022800000,23.84],[1383109200000,24.2],[1383195600000,24.37],[1383282000000,25.92],[1383544800000,25.77],[1383631200000,25.47],[1383717600000,25.61],[1383804000000,25.69],[1383890400000,25.94],[1384149600000,26.35],[1384236000000,26.22],[1384322400000,26.49],[1384408800000,25.07],[1384495200000,25.21],[1384754400000,25],[1384840800000,24.99],[1384927200000,24.94],[1385013600000,25.03],[1385100000000,25.26],[1385359200000,25.32],[1385445600000,25.09],[1385532000000,27.36],[1385704800000,27.35],[1385964000000,27.32],[1386050400