Image source: The Motley Fool.

Intercept Pharmaceuticals (NASDAQ:ICPT) Q4 2018 Earnings Conference CallFeb. 28, 2019 8:30 a.m. ET

Contents: Prepared Remarks Questions and Answers Call Participants Prepared Remarks:

Operator

Good morning, ladies and gentlemen, and thank you for joining the Intercept Pharmaceuticals fourth-quarter and full-year 2018 financial results conference call. [Operator instructions] Please be advised that this call is being recorded at the company's request, and a webcast of this call will be archived on the company's website for approximately two weeks. I would now like to introduce Dr. Mark Vignola, Intercept's executive director of corporate development, investor relations.

Please go ahead.

Mark Vignola -- Executive Director of Corporate Development, Investor Relations

Thank you, operator. Good morning, and thank you for joining us on today's call. This morning, we issued a press release announcing our fourth-quarter and full-year 2018 financial results, which is available on our website at www.interceptpharma.com. Before we begin our discussion, I'd like to note that during our call and question-and-answer session today, we'll be making certain forward-looking statements, including statements regarding the progress, timing and results of our clinical trials, including our clinical trials for the treatment of nonalcoholic steatohepatitis or NASH; the safety and efficacy of our approved product Ocaliva, obeticholic acid or OCA for primary biliary cholangitis or PBC; and our product development candidates, including OCA for NASH; the timing and acceptance of our potential regulatory filings and potential approval of OCA for NASH or any other indication in addition to PBC; the timing and potential commercial success of OCA and any other product candidates we may develop; and our strategy, future operations, future financial position, future revenue, projected costs, financial guidance, prospects, plans, objectives of management and expected market growth.

Listeners are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this call, and we undertake no obligation to update any forward-looking statements except as required by law. These forward-looking statements are based on estimates and assumptions by our management that, although believe to be reasonable, are inherently uncertain and subject to a number of risks and uncertainties. Some, but not necessarily all, of the factors that could cause our actual results to differ materially from our historical results or those anticipated or predicted by our forward-looking statements are discussed in this morning's press release and in our periodic filings with the U.S. Securities and Exchange Commission, including our annual report on Form 10-K for the year ended December 31, 2017.

In addition, please note that OCA is an investigational product that has not been approved by any regulatory authority or any indication other than PBC. No conclusions can be drawn concerning the safety or efficacy of OCA for any other indication at this time. Today's call will begin with remarks from our CEO, Dr. Mark Pruzanski; followed by those from our chief operating officer, Jerry Durso; and our chief financial officer, Sandip Kapadia.

We'll then open the call to take your questions. Let me now turn the call over to our CEO, Dr. Mark Pruzanski.

Mark Pruzanski -- Chief Executive Officer

Thanks, Mark, and good morning, everyone. Thank you all for joining us today on our fourth-quarter and full-year 2018 conference call. Before we recap 2018, I'd like to briefly start off with a reminder of the exciting news we reported last week, the positive top-line readout of our phase three Regenerate study in patients with liver fibrosis due to NASH. Regenerate is the largest and most comprehensive clinical trial ever conducted in NASH and the first and only phase three study to show positive results in this population.

We designed Regenerate in close consultation with FDA to first readout in an 18-month analysis on two primary histologic endpoints with the requirement to meet either one for study success in support of regulatory approval. We were, of course, thrilled to report last week that our once-daily dose of OCA 25 milligrams met the primary endpoint of at least one stage improvement of liver fibrosis with no more STING of NASH, with 23.1% of patients receiving OCA achieving this endpoint, compared to 11.9% of placebo patients on an intent-to-treat basis, highly statistically significant with a P value of 0.0002. This result unequivocally supports OCA's efficacy as an anti-fibrotic agent in patients with advanced NASH, a critically important milestone in the field that sets it apart from any other investigational NASH therapy. Further underscoring this, the observed treatment response to OCA 25 milligrams in approximately twice as many patients as placebo was supported by a number of additional prespecified analysis that will be presented at EASL and other similar forms.

Fibrosis improvement is the most clinically relevant histologic endpoint given the fact that fibrosis alone has been shown in multiple studies to predict liver-related adverse outcomes and all-cause mortality. Since we released the data, we received enthusiastic feedback from external opinion-leading NASH experts, who share the view on how meaningful our results are. Recapping tolerability and safety based on OCA's profile and the close to 2,000 patients in the Regenerate safety cohort, adverse events were generally mild to moderate in severity, and the most common were consistent with the known profile of OCA. This is gratifying to see in the study population approximately sevenfold larger than Flint, providing us with largest safety data base existing for any investigational NASH drug.

Following the top-line results reported last week, we've continued to generate outputs from the trial, and these have reinforced our confidence in the OCA safety profile. We're really looking forward to presenting more detailed study results at the upcoming EASL meeting in April and to publication in a major medical journal. Meanwhile, we're also moving expeditiously in preparing our U.S. and European regulatory filings, which we intend to submit in the second half of this year.

Given OCA's breakthrough therapy designation in NASH fibrosis, we're confident in our prospects for expedited FDA review. As we contemplate all the work that remains to be done, it's important to remember that the success of Regenerate represents a watershed moment for NASH patients, who currently have no available therapeutic options and suffer from a disease that's become a leading cause of liver failure and the reason behind the very concerning rapidly increasing incidents of hepatocellular carcinoma worldwide. We couldn't be more excited to be on the path to bring the first-ever antifibrotic treatment to patients with NASH with the potential to become the established backbone therapy in this indication. Stepping back, I'm thrilled by everything that we accomplished in 2018, which proved to be a critical year of operational execution for us globally.

That success continues to energize us as we look to the year ahead. Over the course of 2018, we made significant progress on our primary business objectives, of course, delivering on our NASH clinical development program and growing our PBC franchise. On the NASH side, in addition to our work to deliver top-line results in Regenerate, we also announced the Reverse trial in compensated cirrhotic patients. This trial continues to enroll well, and we're targeting the completion of enrollment by the end of the year.

We also completed additional safety pharmacokinetic and pharmacodynamic studies in NASH fibrosis and cirrhosis, which will provide further support for our regulatory filings. Turning to the PBC business, earlier this morning, we announced that our 2018 net sales were in line with our previously announced guidance for Ocaliva with $177.8 million in worldwide net revenue. Following the label update in February 2018, we expanded our sales force efforts in the U.S. and continue to drive market access across our approved markets internationally.

These efforts have successfully driven growth. And today, we're pleased to announce 2019 Ocaliva net sales guidance of between $225 million and $240 million. In the fourth quarter, we strengthened our pipeline by acquiring the U.S. development and commercialization rights to bezafibrate, a pan-PPAR agonist.

We intend to soon initiate a study of bezafibrate in combination with Ocaliva and PBC with other liver diseases to follow. In summary, coming off our solid commercial performance with Ocaliva and PBC in 2018, our expectations for Ocaliva's further growth this year and, of course, the landmark positive top-line Regenerate results, I couldn't be more excited about Intercept's future as we embark on our next chapter. With that, I'll turn it over to Jerry Durso, our chief operating officer, for a global commercial update.

Jerry Durso -- Chief Operating Officer

Thanks a lot, Mark, and good morning, everyone. Let me just start by saying that we're pleased with our commercial performance over the past year. We had a strong quarter four with worldwide net sales growth of 42% over the same period last year and worldwide net sales growth of 38% for the full-year 2018 versus prior. In the U.S., our growth was driven by the considerable changes we made in our sales model last year, which increased our PBC coverage by about 50%, with a specific intent on covering more community-based gastroenterologists.

This resulted in uptake in first-time prescribers and more new enrollments from our expanded list of target physicians. We're also encouraged by the recent publication of clinical guidance documents from the leading hepatology and gastroenterology medical societies, AASLD and ACG, both of which solidified the position of Ocaliva as the only approved second-line therapy for the treatment of PBC. Internationally, we continue to secure national pricing and reimbursement, and we see good uptake for Ocaliva in our key markets as a result of our launch efforts. So we're pleased with the international sales growth that we're achieving.

Looking at 2019, we have good confidence in our global PBC opportunity and the sales growth that we expect to see this year. So turning now to NASH. Clearly, we're very enthusiastic about the top-line data from Regenerate, and we're very active with our launch planning and our execution. While there are millions of patients with NASH, we continue to believe the greatest unmet need is those patients with advanced fibrosis due to NASH as they are at greatest risk of developing severe liver-related complications.

As part of our ongoing plan, we conducted a significant amount of qualitative and quantitative market research with over 1,000 hepatologists and gastroenterologists, as well as speaking to endocrinologists, primary care physicians and payers. This substantial body of market research confirms that most physicians think of NASH through a fibrosis lens from diagnosis, staging and desired treatment outcomes. One of the critical priorities for physicians is halting the progression of liver fibrosis in NASH patients as fibrosis has been clearly linked to predicting more severe outcomes and mortality in these patients. Payers are also focused on fibrosis as a critical surrogate endpoint in NASH as they see preventing severe liver outcomes as the greatest unmet need and the largest potential impact on healthcare costs.

Given that, we're extremely encouraged by the meaningful effect of OCA on fibrosis that we saw in Regenerate, which has been reinforced by the positive feedback that we've received from key experts on the top-line data. Overall, the Regenerate data support our belief that OCA has the potential to be a successful treatment for NASH that will meet the needs of both patients and their physicians. Now with Regenerate in hand, we continue to be full steam ahead. We're refining our market view in the context of our phase three data and executing our launch plan preparations for OCA and NASH.

Our quantitative market research data to date tells us that the majority of physicians currently -- the majority of patients currently diagnosed with advanced fibrosis due to NASH, similar to those that we saw in the Regenerate population, are under the care of hepatologists and gastroenterologists, and that the majority of these patients were diagnosed and found their way to specialist care without receiving a liver biopsy. Many of the hepatologists and the GI specialists that we see today will serve as our core customer base in NASH following approval. We've called on these physicians since 2016, and we've built significant insights and credibility that we're leveraging as we prepare for the launch and commercialization of OCA and NASH. Now as we move forward, we'll continue to expand our medical, marketing and payer teams and accelerate our ramp-up consistent with our plan.

We've also built options for how we'll scale in the field to cover the larger NASH customer base. Of course, disease state education is an important component of our medical efforts across the U.S. and in Europe, and our medical colleagues are trained and ready to reactively address questions on Regenerate based on the top-line data and consistent with local regulations and requirements. It's clearly an exciting time following the successful Regenerate readout, and we look forward to sharing additional insights with you as our launch plans progress.

With that, I'll turn the call over to Sandip for a financial update. Sandip?

Sandip Kapadia -- Chief Financial Officer

Thank you, Jerry, and good morning, everyone. Please refer to our press release issued earlier today for a detailed summary of our financial results for the fourth quarter and full year ended December 31, 2018. The fourth quarter of 2018 was a successful quarter in our PBC business as we began to see the impact in the U.S. of our sales force expansion coverage, as well as achieved strong growth in our international markets.

We closed the full year with Ocaliva net sales within the previously announced 2018 sales guidance. With respect to operating expenses, we continued our disciplined approach with a focus on driving the key organizational priorities of advancing our NASH program and supporting our PBC launch. We've broadened our pipeline with the acquisition of a license to the development and commercialization rights to bezafibrate in the U.S. As a result of that transaction, our non-GAAP adjusted operating expenses ended up coming in just over the upper end of the expense guidance range.

We also closed the year with a strong cash balance as we continue to build on the PBC momentum, as well as execute our NASH launch preparations. Getting into more details, we recognized $53.3 million and $179.8 million in total revenue for the fourth quarter and full year of 2018, up from $37.7 million and $131 million for the same period in 2017. For the fourth quarter, Ocaliva net sales comprised of U.S. net sales of $41.1 million and ex U.S.

net sales of $11.8 million. This represents a growth of approximately 29% in the U.S. and a growth of 123% ex U.S. as compared to Q4 2017.

Our full-year Ocaliva net sales were comprised of U.S. net sales of $140.8 million and ex U.S. net sales of $37 million. This represents a growth of 22% in the U.S.

and 176% ex U.S. as compared to 2017. Gross-to-net deductions for the year were within our previously communicated 10% to 15% range. Our GAAP operating expenses for the quarter were $135.3 million, and non-GAAP adjusted operating expenses were $122.7 million.

For the full year, GAAP operating expenses were $465.3 million and non-GAAP adjusted operating expenses were $410.8 million. As a reminder, our non-GAAP adjusted operating expense excludes stock-based compensation and depreciation. Our cost of sales for the quarter and full-year 2018 were $1 million and $2.5 million, respectively. This was an increase of $0.2 million and $1.1 million over the prior year period.

Cost of sales primarily consist of packaging and labeling expenses. Our selling, general and administrative expenses for the fourth quarter and full year were $71 million and $255.5 million, respectively. This was a decrease of $13.4 million and $18.2 million over the prior-year period. The decrease was primarily driven by our efforts to streamline our SG&A expenses.

Our research and development expenses for the fourth-quarter and full-year 2018 were $63.3 million and $207.3 million, respectively. This was an increase of $5.8 million and $15.8 million over the prior-year period. The increase was primarily driven by a $9 million payment made in connection with the acquisition of the U.S. bezafibrate license.

And moving on to our cash position. Given our strong financial performance in 2018, we ended the year with cash, cash equivalents and investable securities of $436.2 million. And now moving to our guidance, 2019 will be a critical year as we need to continue to build on the momentum on our PBC business while deploying resources to support our NASH filing efforts in the U.S. and Europe and executing our NASH launch preparations.

Once again, we'll be taking a disciplined and focused approach with our resources while investing approximately $100 million for our NASH launch effort. We'll also continue to invest in our NASH clinical development programs as Regenerate continues to enroll patients and moves into the outcomes phase of the trial and Reverse continues to enroll patients. We expect worldwide Ocaliva sales in the range of $225 million to $240 million. This represents a net growth range of 27% to 35% for 2018 -- over 2018.

We continue to expect gross to net in the range of 10% to 15% and toward the upper end of the range in Q1 '19. We expect non-GAAP adjusted operating expenses in the range of $450 million to $470 million, inclusive of the filing and launch preparation activities. We also expect interest expense of approximately $30 million related to our outstanding convertible notes, which includes the cash portion and amortization component. As a result, we believe our cash balance of $436.2 million as of December 31, 2018, puts us in a strong position to continue to deliver on our PBC business while executing our launch preparation activities for 2019.

I'd like to just take a moment to remind you of the expected softness in the first quarter of 2019 in the U.S. as insurance plans reset. We typically plan for increase in Q1 gross-to-net, which will further be impacted by manufacturer's responsibility for coverage GAAP increase in 2019. Although we expect robust net sales growth in Q1 2019 versus Q1 2018, we expect a slight decline in net sales during the first quarter of 2019 as compared to the fourth quarter of 2018 before returning to growth for the balance of 2019.

Finally, as a reminder, non-GAAP adjusted operating expenses is a non-GAAP financial measure under SEC regulations. Please refer to this morning's press release for an explanation and reconciliation of this measure. So with that, I'd like to turn it over to the operator for any questions. Operator?

Questions and Answers:

Operator

[Operator instructions] Our first question comes from Michael Yee with Jefferies.

Michael Yee -- Jefferies -- Analyst

A couple of things. One is we've seen the top line for Regenerate now, and I think various KOLs have come out and talked to the data about positive data but need to see details. And you've come out on your last call talking about your underlying confidence in the overall risk benefit. Mark, I think you made some comments about that in the last call.

So yet there seems to be some market uncertainty about safety. Maybe, Mark, two things. One is can you tell us about what gives you that underlying confidence? Have you done eDISH data on hepatic safety? What do we know about that and any Hy's law cases? And secondly, there's recent publications out there that we have that talks to liver injury and fatty liver. What do we know about how to interpret liver injury and things like NASH? What do we know about that? And how does the FDA think about stuff like that? Maybe you could talk to those two things, I think that'd be helpful.

Appreciate it.

Mark Pruzanski -- Chief Executive Officer

Sure, Mike. Thanks. Yes. I mean, look as you mentioned, we're really happy with the totality of data in hand.

And we really do believe that it supports the overall benefit risk of OCA 25 milligrams going forward. With respect to your question on liver-related safety specifically, you mentioned that a paper on assessing drug associated liver injury in NASH specifically, that came out last month. It was co-authored by a group of NASH experts and representatives of FDA and does represent the latest thinking on how to assess an investigational NASH drugs potential for liver injury in the NASH setting. And I think highlights there what we've been saying and that is in the context of NASH or any active advanced liver disease in assessing cases of potential liver injury, there are a number of confounders to investigate, including the concomitant meds known to be potential causes of liver injury that these patients are often on, the progression or complications of the underlying disease itself, intercurrent illnesses like infections that these patients often experience and other factors before you even get to the study medication itself.

Now that said, you asked about eDISH, as I mentioned in my prepared remarks, we've continued to run analysis generating a lot of outputs on the data. eDISH is one of them that we just completed, and it remains a very effective tool at a population level of really stressing out potential for any drug to be a cause of liver injury in a clinical trial setting. Just as a reminder, what it does quite simply is plot peak total bilirubin and ALT liver enzymes lab values for every patient participating in the trial over the duration of this study, and you look for telltale signs of clustering or potential liver injury. For Regenerate, in the overall safety population, the resulting eDISH plot looks very reassuring.

It looks very similar to the Flint eDISH that we presented last year at EASL. And just to highlight a couple of things that we observed, one is that just as in Flint, there's a disproportionate number of patients in both OCA arms and particularly OCA 25 milligrams who remain in the normal or near-normal quadrant of the plot, and we believe that reflects the efficacy of the drug in improving liver enzymes overall. And with respect to Hy's law, there were exceedingly few patients who entered the Hy's law quadrant, specifically three on placebo, two OCA 10 and just one in the OCA 25-milligrams group. So this underscores the reassuring nature of the eDISH.

But of course, it's just one tool. It's important to note that none of the Hy's law patients were recorded as having an SAE, a liver-related SAE. And so that again underscores the reassuring nature of the safety data we've got in hand.

Michael Yee -- Jefferies -- Analyst

So let me clarify that, Mark. You're saying that there were a disproportionate number on placebo actually and not on OCA, so that is important, and that's what you're seeing.

Mark Pruzanski -- Chief Executive Officer

Yes. And again, it highlights the complexity of assessing liver injury in a NASH trial or any active liver disease because of the confounding factors that I mentioned. And that said, whether it's liver-related or other organ system of interest kind of SAE, all of these require specific adjudication investigation. And we continue to do work on cases of interest.

Operator

Our next question comes from Brian Abrahams with RBC Capital Markets.

Brian Abrahams -- RBC Capital Markets -- Analyst

A commercial one and a clinical one. On the commercial side, on your Ocaliva guidance for this year, can you give us any general sense of approximately how we should be thinking about continued U.S. growth versus the increasing international contribution? And then maybe on the -- you talked about the safety side. Maybe on the tolerability side, coming out of Regenerate on pruritus, can you give us any more details on the time course there? Should we be thinking about this as just more of a transient type of event? Clarify what the breakdown of mild versus moderate looked like.

And then just based on your experience managing the pruritus both on the Regenerate study and in commercial PBC setting, I'd be curious as to your sense is in the real world what patient persistence might look like relative to the clinical trial setting with respect to this tolerability issue.

Mark Pruzanski -- Chief Executive Officer

Thanks, Brian. I'll ask Sandip to take the first question. I'll take the second.

Sandip Kapadia -- Chief Financial Officer

Yes. Thanks for the question. I think, look, in terms of phasing and seasonality, I mean, I kind of indicated that at least in the first quarter of the year, we generally see a softness, which is broad by the industry trend generally from a higher insurance plan reset, and we just see a softness usually in the first quarter. So the U.S.

tends to be a little bit softer in the first quarter. Of course, as you know, we have our IMS data out there, so you can certainly follow along on the launch, I think. But we see that as a very slight impact in the first quarter, but then, of course, we expect to return to growth based on our guidance that we certainly provided. I think ex U.S., the way to also think about it is at this point, we launched in all the key markets in Europe.

And so we see basically a slow and steady continuation of the growth that we're seeing in Europe as well. So again, some softness in the first quarter, but then I think good growth for the balance of the year. In our guidance, I believe it reflects that as well. And then maybe, Jerry, you want to take the commercial.

Jerry Durso -- Chief Operating Officer

Yes. So yes, with respect to your second question, Brian, on pruritus, look, I mean, this is obviously an expected side effect, dose-dependent side effect of our drug. What's clear in the field of FXR is that this appears very much to be a class effect and on-target FXR-associated effect. And that said, a couple of comments.

One is that it's important to remember going into this study that everyone involved, patients, investigators, study coordinators who are highly sensitized to pruritus, who are looking for pruritus, you only need to look at the placebo rate of incidents close to one in five patients on placebo reporting it, which was over three times, threefold greater rate than was observed in the Flint study to see the effect of this. And second, again, we have very extensive experience starting at the PBC side. Also, we learned a lot from the Regenerate study in how to manage pruritus. The vast majority of cases are mild or moderate.

You asked about time course. We don't have that yet. Obviously, we're digging into that. But if we observe the same kind of pattern as we did on the PBC side, then most patients susceptible to it will experience it near to the initiation of their therapy, which is good news in the real world in terms of being able to deal with it as it comes up, and there are tried and true ways, of course, to manage it.

And then what we've also observed in PBC side is the patients who do experience it, there tends to be an adaptive effect. It tends to ameliorate over time. Of course, we have to take a look at that in the context of the Regenerate study in the NASH population. And Jerry...

Yes. I guess, finally, when we think about the pull-through to the NASH launch, obviously, as you mentioned, our experience in PBC, I think, has allowed us to learn a lot how to manage in the real world. I think the combination of our ability to educate the physicians consistent actually with information both in the guidelines and in our label helps the management of pruritus, I think, how we're providing patient support, particularly in the key early part of therapy, which as Mark mentioned, is the period where hopefully both physicians and the patients can understand how to deal with unexpected effect in some patients clearly based on the mechanism. So I think as we're approaching launch, we're bringing the learnings from PBC through.

I think as we look at the data, we will also be able to really target the support that we're going to be able to provide effectively. And we feel pretty good about our ability to have the right kind of plan in place to achieve exactly what we'll try to do, which is keep patients on the therapy they need to stay on.

Operator

Our next question comes from Alethia Young with Cantor Fitzgerald.

Alethia Young -- Cantor Fitzgerald -- Analyst

Helpful color on the Hy's law stuff. I just wanted to ask two kind of questions. One's kind of clarifying. But in the case of safety analysis that you're doing heading into the data set at EASL, would you characterize this eDISH analysis as kind of the core piece and gives you significant confidence that the hepatic risk signal is low? And then a second question is just I was just trying to figure out when thinking about like building a sales force here.

I know you have a lot of relationships from PBC. So is the investment in NASH that we should think about, is it more like kind of awareness and marketing than it is adding significant sales? Or is it a mix of both things?

Mark Pruzanski -- Chief Executive Officer

Yes, Alethia. With respect to your first question, look, the eDISH is a very important tool and is standard way of evaluating potential for liver injury. So we're obviously very reassured by the results of eDISH analysis in Regenerate. That said, it's the start.

I mentioned a few minutes ago that every reported SAE, liver-related SAE, is something that needs to be independently adjudicated. So we'll have a more fulsome picture here that we'll look for to reporting out on over time. But I do want to reiterate and restress again how reassuring the data that we have in hand look.

Jerry Durso -- Chief Operating Officer

Yes, Alethia, thanks for the question. I'll take the second half of that. I think when we think about the preparation for launch and the investment, it is clear and evident that there is education that needs to happen in the market on the medical side, on the payer side. So that will be a core part of the effort when thinking about the sales force, obviously, ensuring an effective sales team is going to be the key ingredient in the launch like it is in every launch.

It is a larger group of target physicians than we're calling on for PBC, although you should think about the PBC audience as being really at the core of that. So there is a good overlap, but it is a broader reach. As we expand, we expect to stay primarily with hepatologists and the GI specialists, but it is a broader group of community-based GI specialists. So there is an incremental build that we'll be prepared to move toward and ramp that up at the right time to be prepared for a successful launch.

Operator

Our next question comes from Ritu Baral with Cowen.

Ritu Baral -- Cowen and Company -- Analyst

The first question revolves around something that you said on the market research side pertaining to biopsy. I think you guys mentioned that most patients made it to hepatologists and GI specialists without a real biopsy in their diagnosis. Is that something that you guys plan to address as part of your prelaunch efforts? Is it feasible to make a sort of campaign to get a formal biopsy before launch in an effort to expedite the launch? And then I have a follow-up.

Jerry Durso -- Chief Operating Officer

Yes. Maybe I'll take that one. Thanks for the question. As we have found out through the market research that the patients who are currently diagnosed, particularly the ones that have more advanced disease, have found their way into the system without a biopsy.

There was a variety of different means that are being utilized and different combinations, frankly, not exactly consistent. As we look at the U.S. market, imaging is used, different blood panels, obviously. There is good, I think, alignment, relative alignment across the physician side that they are not looking to utilize biopsy.

I think everybody's aware of the challenges that broad-based biopsy creates in the system. So I think that we'll have a lot more insight and information coming out of Regenerate, frankly, in terms of some of the noninvasive diagnostic measures. And we'll clearly look at that in a lot of detail as we move forward. But we don't anticipate that the market will be pushing to move toward biopsy.

And clearly, part of our goal is going to make it -- to help the system make it as easy as possible to diagnose the right patients that need therapy with the existing methods that are out there.

Mark Pruzanski -- Chief Executive Officer

I was just going to add that and you and I have talked about this before, that it just again highlights how critically important the fibrosis benefit really is. Because the noninvasive means of diagnosing and staging these patients that are approved and used today at point of care look specifically at fibrosis, right? The only exception would be -- in the research setting would be quantification of fat typically with MR-PDFF, but that alone does not tell you much about how much disease and whether you actually have full-blown NASH or not. So both from a clinical and a commercial standpoint, we think that the value prop here with an antifibrotic benefit is crucial for the success of this drug. And of course, the noninvasive means of assessing staging fibrosis are just getting better and better as we go.

Ritu Baral -- Cowen and Company -- Analyst

So the strategy that you outlined, the potential for not needing a biopsy diagnosis, is that based on some of your peer conversations that you've had so far?

Jerry Durso -- Chief Operating Officer

Yes, I mean -- so we're obviously having the normal discussions with payers and going through the right kind of disease state discussions with them. I think one of -- a couple of points, which are extremely relevant from the payer side, they are interested in the advanced patients as a priority, the patients that they are looking to make sure they're able to address and try to avoid the long-term complications and all the implications that that creates from the payer side. Again, we'll have a lot more in-depth discussion now with the data in hand. But payers also recognize the challenges that are inherent in biopsy, and I think they're looking at that and understanding that in the context of trying to make something feasible that works with the kind of variability that's out there in the market currently.

Ritu Baral -- Cowen and Company -- Analyst

Got it. And my follow-up is for Sandip. Sandip, when you laid out OPEX guidance, it doesn't imply a whole lot of growth. But you did say that there's going to be about $100 million launch costs.

That implies paring of other programs or paring around the edges of other expenses. What are you pulling back on in order to meet that guidance?

Sandip Kapadia -- Chief Financial Officer

No. I think, look, as I mentioned previously, we tend to take a very disciplined and focused approach in terms of resource allocation. And as we did last year, I mean, we're very much focused on the key organizational priority. And for us, it's clearly going to be the launch preparation for this year will be clearly an organizational priority.

Of course, continuation of our NASH program with Regenerate and Reverse again continue to be a major priority for funding. And then, of course, continue to support the PBC business. But we're also at third-year launch in PBC, so we got good momentum there. And we certainly look at always opportunities to either reallocate resources or to ensure that we're really very much focused on what's really important to the organization and what are the key value drivers overall.

Ritu Baral -- Cowen and Company -- Analyst

Just for modeling purposes, is it safe to assume that SG&A is going up year over year and that the efficiencies may come from R&D?

Sandip Kapadia -- Chief Financial Officer

No, I think, look, R&D will continue given the fact that we're continuing to invest in Regenerate and Reverse. I mean, they're continuing to enroll, and the studies continue to grow. So our R&D expenses would generally be expected to continue at current year level. And I think the key increase you'll see is probably on SG&A.

Operator

Our next question comes from Steven Seedhouse with Raymond James.

Steven Seedhouse -- Raymond James -- Analyst

Just one on safety, and then I have a follow-up about outcomes. So just first digging in on the hepatic serious AEs, you mentioned one confounder being concomitant meds. I believe statins actually have about a 1% serious hepatic AE rate themselves. So I'm wondering if an increased statin use here in the high-dose arm, which it seems like there may have been given the LDL data, could explain the numerical imbalance in the high-dose R&D you reported.

So I guess, the questions are was statin use higher in the high-dose OCA arm? And did the hepatic SAEs, in fact, occur in patients that were on statins? And just last, you mentioned that the SAEs did not include anyone in the highest quadrant of the eDISH. So what types of SAEs were observed? And is it consistent with the statin SAE profile?

Mark Pruzanski -- Chief Executive Officer

Yes. Look, it's a good question, and I think statins are just one drug that patients with NASH are frequently on. I would say the answer to your question, as I mentioned a few minutes ago, we're viewing these cases now. We just reported out on top line.

So we simply don't yet know what the profile of these SAEs really look like. What I can tell you though is that it is true that in rare instances, patients starting on statins do experience typically transient spikes up in liver enzymes. It's possible that liver injury could result, but I think it's exceedingly rare. And in fact, so rare that both AASLD and EASL in their guidelines strongly recommend that patients with NASH take statins who are dyslipidemic because of the safety and benefit in the profile of statins.

I'll also remind you -- and we'll obviously take a look at this in Regenerate, but I'll remind you of a couple of data points. One is in Flint. When we took a look at patients who either were already on a statin at baseline or who had a statin added over the course of the study, those patients actually ended up with even lower liver enzymes than patients who were statin-naive in Flint. And in that study at least, there's no evidence of any safety issue.

And then, of course, CONTROL, the study that we read out on last year when we prospectively looked at the effect of adding atorvastatin to OCA and show that low-dose atorvastatin in a vast majority of cases controls LDL, we saw no evidence of any kind of safety issue there. So I would be surprised to see any effect. But of course, it's possible, and we just don't know yet. I forget the second part of your question.

Steven Seedhouse -- Raymond James -- Analyst

You answered it. It was just about the types of SAEs you observed and if they were consistent with the statins. It sounds like the statins...

Mark Pruzanski -- Chief Executive Officer

Yes. And again, important to remember that a lot of these patients, I mean, these patients have a lot of comorbidities. They're often on polypharmacy and taking medications that are well-known potential causes of liver injury. So it's important again to understand the complexity here and to look at every single case.

And that said, there's an exceedingly small number of cases here, less than one -- significantly less than 1% incidence in each arm of the study. So we've got a very few cases to look at, which is ongoing work as a standard practice.

Steven Seedhouse -- Raymond James -- Analyst

OK. And on outcomes, I'm curious if you have the ability to or will, in fact, amend the design of the long-term outcomes portion of Regenerate, whether that's total enrollment or a number of events, just now that you actually have the 18-month histology data in hand that can presumably update your assumptions about the effect size of OCA and how that might translate to outcomes benefit. And then maybe to slide one last one. You mentioned the planned publication of Regenerate data.

Will that coincide with the EASL presentation?

Mark Pruzanski -- Chief Executive Officer

Yes. So good question with respect to outcomes. Obviously, we took a look at progression to cirrhosis in very small numbers but encouraging from a directional standpoint but too a small number to say anything about. No doubt, we'll be taking a look along with FDA at the results of the data, what the progression rate suggests and whether to tweak our assumptions.

But I'm happy to say that the study continues to enroll very well. We randomized well over 2,000 patients. The anecdotal feedback we've heard from investigators around the world participating in the study, as we alluded to in our prepared remarks, has been nothing less than heartily enthusiastic about these results. And we will continue to enroll the study to include as many patients as we think we need for the outcomes portion.

Publication, we're moving expeditiously to publish in a major journal as soon as possible. I can't represent that this will be simultaneous with EASL, but it'll be as soon as we can get it out there.

Operator

Our next question comes from Salveen Richter with Goldman Sachs.

Ross Weinreb -- Goldman Sachs -- Analyst

This is Ross on for Salveen. Just in regards to the payer front and given the ongoing dynamics in the metabolic space, can you comment on where you think you may end up for price for OCA and NASH and just how this would impact OCA and PBC? And then secondly, can you just comment on where you stand on the pipeline with your second-generation FXR, as well as your PSC and biliary atresia programs?

Jerry Durso -- Chief Operating Officer

This is Jerry. Maybe I'll take the first one, and then Mark can answer the question on the pipeline. So I mean, I guess, first and foremost, clearly coming off of top-line data, we're confident that the Regenerate outcome gives us a strong foundation for our value proposition. It is an area of high unmet need, particularly when you look at the patients with advancing fibrosis, which will be the focus of our launch in NASH.

And obviously, as I mentioned before, the drug's ability to impact fibrosis is going to be an important surrogate endpoint for the payers. They're looking to address the long-term challenges. We've been, for a considerable period of time and moving forward, working on the price and value argumentation. And with data in hand now, we have an opportunity to do some further work, refine the pricing strategy, and we'll continue to engage with the key stakeholders.

It's a little premature to comment any further on where we're going to go on pricing except to say we're focused on the fibrosis benefit, the advanced patients where we believe our value proposition is going to be the strongest and as critical that the right access strategy for NASH is going to be an important part of the launch. So we'll continue our work. And I'm sure we'll update you in the future as we progress more closely to launch.

Mark Pruzanski -- Chief Executive Officer

Yes. With respect to your pipeline question, just start with bezafibrate, which I mentioned in my prepared remarks, just to remind you, this is a pan-PPAR agonist that we unlicensed. Our next priority is to initiate a phase two serum combination with Ocaliva. And we said this at JP Morgan, we're very happy to bring this asset in because based on all the data that have been published on this compound, we believe that it looks as good, if not better than any other PPAR in the class.

Certainly, that's true in the PBC setting, and we'll be looking at other liver indications with it. So that's great news, and we disclosed today the upfront licensing fee for that compound, which is Phase II ready. With respect to our other bile acid analogs, specifically 767 and 787, we're continuing to do a lot of work on potential indications for 767. And we'll be providing an update later in the year on that.

And 787 is still preclinical, but we're moving that along to the clinic. We're positioning that as potential follow-on compound to OCA. And what's really exciting about it is that it is a highly selective FXR agonist with preclinically, a better-looking antifibrotic efficacy profile as compared to OCA so differentiated from OCA with a very long patent life. And then finally, we'll be looking to building the pipeline further.

Based on our success in NASH, we'll be looking at potential combo plays. Going forward, we think we've got a lot of optionality on that front so stay tuned for more news over the course of the year.

Operator

Our next question comes from Brian Skorney with Baird.

Trevor Brown -- Baird -- Analyst

This is Trevor on for Brian. I was wondering if you could review the protocol definition for the final analysis endpoint in Regenerate and the definition of liver-related serious adverse events? And is there any overlap between those definitions?

Mark Pruzanski -- Chief Executive Officer

So the composite primary outcomes endpoint in Regenerate includes progression to cirrhosis, meld score north of 15, decompensation events like bleeding varices, liver transplant and all-cause mortality. I think that I'm saying that from memory. I think that captures the composite endpoint. Of course, given that this is a pre-cirrhotic population at baseline, we expect that most of the events that we'll record will be progression to cirrhosis that which will be biopsy proven.

As a reminder, patients continue on study. The patients who were first enrolled have now passed the three-year mark on study, and we have another scheduled biopsy at four years. So now with respect to your second question, SAEs, they can vary in nature. Remember that these are investigator reported preferred terms, right? So there's really a lot of variety.

And really, they don't have much to do with the events that we're talking about that define the outcome's endpoint, except they can overlap with respect to a preferred term that an investigator chooses to use.

Operator

Our next question comes from Navin Jacob with UBS.

Unknown speaker

This is Martin on for Navin. Thinking about the signal we saw in Gilead F4 study and looking forward to Reverse, can you talk about if fibrosis improvement is more difficult to show in the F4 patient population? Then I have a follow-up.

Mark Pruzanski -- Chief Executive Officer

Yes. So look, it would stand to reason that it's more difficult to Reverse cirrhosis, but it has been shown to be possible in the context of liver disease and that includes NASH, with respect to patients who have bariatric surgery, the -- and in the hep C setting of patients who have been -- hep C cirrhotics who have been cured of hep C. In Reverse, we've been very careful with patient selection, making sure to enroll patients with earlier-stage compensated cirrhosis who really have a chance of reversing their cirrhosis, reversing the fibrosis in their liver and going from F4 to F3. Based on the results that we just reported in Regenerate, where we unequivocally shown the antifibrotic benefit of our drug in patients up to and including F3 bridging fibrosis, we're confident in the ability of the drug to do so in patients with compensated NASH cirrhosis.

Operator

Our next question comes from Jay Olson with Oppenheimer.

Jay Olson -- Oppenheimer -- Analyst

You mentioned in the prepared remarks that payers are most interested in advanced fibrosis. So will that be F3 and F4 patients? Or do you expect reimbursement for F2 patients? And then how important is it to get the Reverse study results into the label for the commercialization of OCA and NASH? And then I had a follow-up question.

Jerry Durso -- Chief Operating Officer

Yes. I think so the payers think about advanced fibrosis as a progressive situation. I think it's probably a little too early to clarify exactly where that line is between F2 and M3. But clearly, they understand that as patients progress throughout the fibrosis range, they are accumulating risk.

And again, their goal is to make sure they're doing what they can to avoid the long-term complications. Obviously, we're going to learn a lot more as the Regenerate data comes out, and we start to understand the effect. And the payers are clearly interested in digging into the data and making further assessment with our full dataset in hand.

Jay Olson -- Oppenheimer -- Analyst

OK. And then, I guess, you mentioned some work you're planning to do on bezafibrate, a Phase II combination with Ocaliva for PBC. Could you comment on the complementary nature of that combination? Is that more oriented toward efficacy? Or is that a safety and tolerability advantage by reducing the pruritus and LDLC? And then also can you maybe comment on what is the greatest value driver for a combination of bezafibrate and OCA. Is it in PBC? Or is it in NASH?

Mark Pruzanski -- Chief Executive Officer

Yes. Thanks for the question. Look, based on our preclinical work, there is complementarity there. And I would say, first and foremost, we'd be focused on improving the efficacy profile of the combination.

By the way, just a reminder, our longer-term goal here is to develop the fixed-dose combination. I think that there's clearly a good amount of intriguing evidence for the potential of bezafibrate in PBC specifically. I think, obviously, on the NASH side, as you asked, there's also a lot of interest in the PPAR class in general on the NASH side. So that would be something that we would certainly be interested in exploring with the combination on top of OCA.

But it's premature for me to guess where that combo would be most effective. But certainly, there's a mechanism-based rationale for testing and also in other liver diseases.

Operator

Our next question comes from Yasmeen Rahimi with Roth Capital Partners.

Yasmeen Rahimi -- ROTH Capital Partners -- Analyst

Two questions. One on bezafibrate. So can you tell us what is left to do in order to drive the combination? Is the long-term talk completed so you could run potentially a 52-week study, if not longer needed to be? And then I have a commercial question.

Mark Pruzanski -- Chief Executive Officer

Sure. So as we reported out at JP Morgan, we unlicensed the U.S. rights to develop and commercialize the bezafibrate compound, and we transferred the IND. There has been a lot of talks work done, and that gives us the platform to advance straight into a Phase II study.

Yas, I can't comment right now about additional nonclinical work that we may need to complete. But it's certainly not very limiting for us to go forward in the PBC and potentially other indications.

Yasmeen Rahimi -- ROTH Capital Partners -- Analyst

And then my follow-up question in regard to commercial plans are what percentage of NASH patients are under the care of hepatologists, gastroenterologists versus primary care physicians? And I assume that probably NASH awareness is probably greater than primary care centers. Then how do you plan to tackle that?

Jerry Durso -- Chief Operating Officer

Yes, I'm sorry. I heard the first part of your question, but can you repeat the second?

Yasmeen Rahimi -- ROTH Capital Partners -- Analyst

Yes. The second part is just in regard to NASH awareness. I assume that NASH awareness is probably not as present in the primary care centers versus in the hepatology and gastroenterology offices. So do you plan also addressing that being in the primary care centers bringing awareness to NASH and educating them?

Jerry Durso -- Chief Operating Officer

Yes. OK. So I'll try to take them both together. In terms of the patients that are currently diagnosed with NASH and advancing fibrosis similar to the patients that we studied in Regenerate, the majority of those are under the care of heps and GIs.

Obviously, there's a relatively narrow group of hepatologists, and then there's a group of GI specialists that tends to be where the NASH patients are being treated currently. There is more awareness among the hepatology group. It's emerging in gastroenterology. But clearly, we will have a lot of work to do in terms of educating that segment of the treaters as well, and that will be the focus.

Those two groups will be the primary focus of our launch efforts on the education side and ultimately upon approval on the promotion side.

Operator

Our last question is from Michael Morabito with Credit Suisse.

Michael Morabito -- Credit Suisse -- Analyst

First, I just want to get a little bit more clarity on the different fibrosis stage with the initial launch of -- is there any plans to try to get the F1 high-risk patients in the label based on the data that you reported? And is there any chance that F4 patients could be targeted with this since there will be no treatment available for those patients until at least the Reverse trial reads out? And second, I just want to know is there any evidence that you've seen so far that there was any unblinding of patients in the trial by itself, unblinding through like noticing itchiness or anything like that?

Mark Pruzanski -- Chief Executive Officer

Let me take the second one because there's a rumor going around. No, there is no evidence of that in any clinical trial among clinical trial patients, obviously, trying to guess what they're on. But we've had no reports of that whatsoever. So with respect to your first question, F1s and F4s, we thought it was very important to include the exploratory cohort of high-risk F1s.

The next most important analysis to the ITT primary endpoint analysis was the full population, which we reported out top line last week. And certainly, we anticipate FDA is going to be very interested in taking a look at the data in the total population. And as we learn more and more about the natural progression of the disease, we learned that there are patients at different fibrosis stages who progressed faster or were more at risk of developing hepatocellular carcinoma, for example, including on a precirrhotic basis. And so while we can't second-guess right now if the earlier-stage patients will be included in the label or what the indications statement would look like, certainly we know that FDA will be looking at the totality of data in the population and assessing unmet need across the population in the efficacy of OCA.

With respect to F4s, obviously, the definitive study is Reverse, which is ongoing and enrolling well, as I mentioned in our prepared comments. And in the meantime, we've also completed safety and PK/PD work in several different studies, both which would be supportive of our filings. So again, I can't speculate on whether that means FDA will give access in the initial approval to these patients. But certainly, we have important data to submit in that segment of the population.

Operator

[Operator signoff]

Duration: 63 minutes

Call Participants:

Mark Vignola -- Executive Director of Corporate Development, Investor Relations

Mark Pruzanski -- Chief Executive Officer

Jerry Durso -- Chief Operating Officer

Sandip Kapadia -- Chief Financial Officer

Michael Yee -- Jefferies -- Analyst

Brian Abrahams -- RBC Capital Markets -- Analyst

Alethia Young -- Cantor Fitzgerald -- Analyst

Ritu Baral -- Cowen and Company -- Analyst

Steven Seedhouse -- Raymond James -- Analyst

Ross Weinreb -- Goldman Sachs -- Analyst

Trevor Brown -- Baird -- Analyst

Jay Olson -- Oppenheimer -- Analyst

Yasmeen Rahimi -- ROTH Capital Partners -- Analyst

Michael Morabito -- Credit Suisse -- Analyst

More ICPT analysis

This article is a transcript of this conference call produced for The Motley Fool. While we strive for our Foolish Best, there may be errors, omissions, or inaccuracies in this transcript. As with all our articles, The Motley Fool does not assume any responsibility for your use of this content, and we strongly encourage you to do your own research, including listening to the call yourself and reading the company's SEC filings. Please see our Terms and Conditions for additional details, including our Obligatory Capitalized Disclaimers of Liability.

10 stocks we like better than Intercept PharmaceuticalsWhen investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has quadrupled the market.*

David and Tom just revealed what they believe are the ten best stocks for investors to buy right now... and Intercept Pharmaceuticals wasn't one of them! That's right -- they think these 10 stocks are even better buys.

See the 10 stocks

*Stock Advisor returns as of February 1, 2019

Analysts expect that WesBanco Inc (NASDAQ:WSBC) will announce sales of $128.15 million for the current quarter, Zacks Investment Research reports. Four analysts have provided estimates for WesBanco’s earnings. The highest sales estimate is $130.46 million and the lowest is $126.11 million. WesBanco posted sales of $97.27 million in the same quarter last year, which would indicate a positive year over year growth rate of 31.7%. The business is expected to announce its next quarterly earnings report on Tuesday, April 16th.

Analysts expect that WesBanco Inc (NASDAQ:WSBC) will announce sales of $128.15 million for the current quarter, Zacks Investment Research reports. Four analysts have provided estimates for WesBanco’s earnings. The highest sales estimate is $130.46 million and the lowest is $126.11 million. WesBanco posted sales of $97.27 million in the same quarter last year, which would indicate a positive year over year growth rate of 31.7%. The business is expected to announce its next quarterly earnings report on Tuesday, April 16th.

Source: Shutterstock

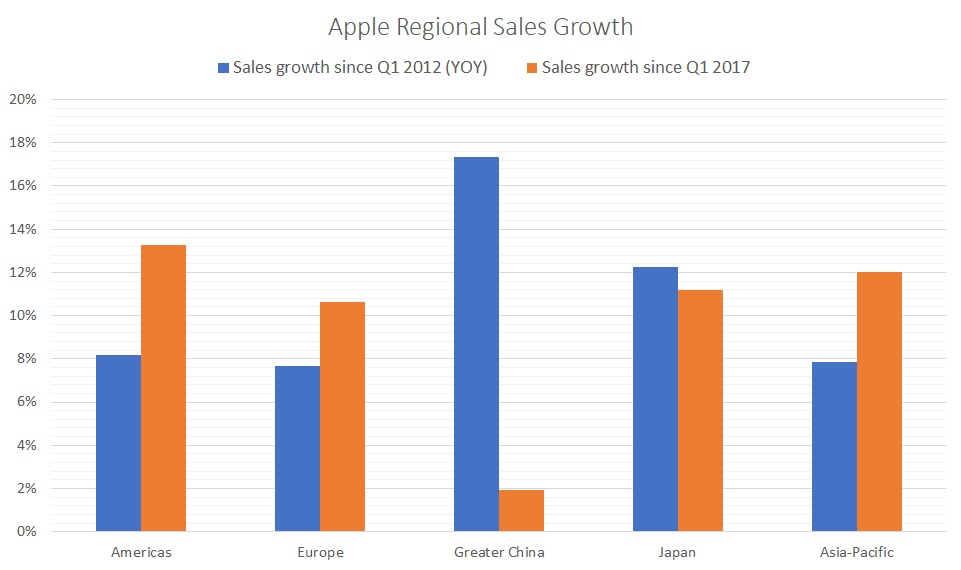

Source: Shutterstock  Since the first quarter of 2012, China has unquestionably been the king of Apple’s growth. On a year-over-year basis, Apple’s “Greater China” sales have risen by an average of 17.4%. No region besides Japan experienced double-digit growth over that period.

Since the first quarter of 2012, China has unquestionably been the king of Apple’s growth. On a year-over-year basis, Apple’s “Greater China” sales have risen by an average of 17.4%. No region besides Japan experienced double-digit growth over that period. Wall Street analysts forecast that KEYW Holding Corp. (NASDAQ:KEYW) will announce sales of $127.90 million for the current quarter, Zacks reports. Five analysts have provided estimates for KEYW’s earnings. The highest sales estimate is $129.42 million and the lowest is $126.99 million. KEYW posted sales of $126.88 million during the same quarter last year, which suggests a positive year-over-year growth rate of 0.8%. The firm is expected to announce its next quarterly earnings report before the market opens on Tuesday, March 12th.

Wall Street analysts forecast that KEYW Holding Corp. (NASDAQ:KEYW) will announce sales of $127.90 million for the current quarter, Zacks reports. Five analysts have provided estimates for KEYW’s earnings. The highest sales estimate is $129.42 million and the lowest is $126.99 million. KEYW posted sales of $126.88 million during the same quarter last year, which suggests a positive year-over-year growth rate of 0.8%. The firm is expected to announce its next quarterly earnings report before the market opens on Tuesday, March 12th.