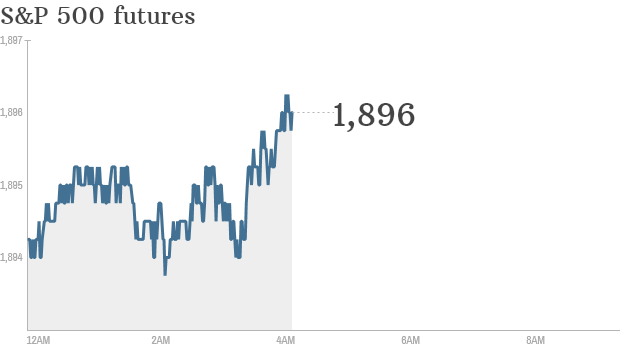

Click chart for in-depth premarket data.

NEW YORK (CNNMoney) The "sell in May and go away" market refrain doesn't seem to apply this year as stocks continue to push into record territory.U.S. stock futures were inching up Tuesday ahead of the opening bell.

The Dow Jones industrial average and the S&P 500 closed at record highs Monday, and the Nasdaq climbed by about 1.8%.

Meanwhile, economic releases could affect investor sentiment. The U.S. Census Bureau will report April retail sales at 8:30 a.m. ET. At the same time, the Bureau of Labor Statistics will release import and export price data.

It's expected to be a relatively quiet day on the earnings front. Fossil (FOSL) will report earnings after the closing bell. Big retailers such as Wal-Mart (WMT, Fortune 500) and Macy's (M, Fortune 500) will be reporting later in the week.

Shares of DirecTV (DTV, Fortune 500) were surging by roughly 5% in premarket on reports that AT&T (T, Fortune 500) may make a bid to buy the company.

Shares in Airbus (EADSF) were rising by 5% in Europe after the firm reported better-than-expected quarterly results.

Investors will also be focusing on developments in the pharmaceutical industry Tuesday. The American drug maker Pfizer (PFE, Fortune 500) wants to buy Britain's AstraZeneca (AZN) and both CEOs will appear before a U.K. parliamentary committee to answer questions about the potential takeover.

In Asia, India's benchmark Mumbai Sensex index surged to a record high Tuesday after election exit polls indicated that voters will deliver a mandate to Narendra Modi and the pro-business Bharatiya Janata Party.

Most other regional markets ended with gains. The Nikkei in Japan jumped by 2%.

All European markets were rising in morning trading. Germany's Dax index was making the biggest advance, up by 0.8% ![]()

No comments:

Post a Comment